Homeowners insurance protects against financial losses from unforeseen events, covering both home structure and personal belongings. Policies include coverage limits and deductibles, with regular premium payments. Key types are basic (common perils) and comprehensive (broader protection). Annual reviews, strategic bundling, staying informed about local codes, and proactive policy management ensure optimal protection.

In today’s dynamic real estate landscape, understanding homeowners insurance is more crucial than ever for consumers looking to protect their most valuable asset—their home. Navigating the complex web of policy terms, coverages, and exclusions can be a daunting task for folks who are new to homeownership or simply reviewing their existing policies. This authoritative report breaks down the intricacies of homeowners insurance, providing a comprehensive guide that empowers consumers to make informed decisions. By the end of this article, you will naturally grasp what homeowners insurance entails, common policy pitfalls, and how to optimize your coverage to safeguard your investment.

Understanding Homeowners Insurance: Basics Explained

Homeowners insurance is a crucial component of financial security for any property owner. It serves as a safety net, providing protection against unforeseen events that could lead to significant financial loss. At its core, homeowners insurance offers coverage for the structure of your home and personal belongings within it. This includes protection against risks such as fire, theft, vandalism, and natural disasters like hurricanes or earthquakes. When you purchase homeowners insurance, you are essentially creating a partnership with an insurance company, where they agree to compensate you for covered losses in exchange for regular premium payments.

Understanding the basics of homeowners insurance involves familiarizing yourself with key terms and concepts. One such term is ‘coverage limits’, which represent the maximum amount your insurer will pay out for specific claims. For instance, if your home suffers water damage due to a burst pipe, your coverage limit will dictate how much the repair or replacement costs will be covered. It’s also important to know about deductibles—the amount you must pay out-of-pocket before insurance kicks in. A higher deductible typically leads to lower premiums but requires a greater financial contribution from the policyholder during claims.

Homeowners insurance borrower requirements vary depending on location and insurer, but certain standards are universal. For example, lenders often require borrowers to have sufficient coverage to replace or rebuild their home if damaged beyond repair. This ensures that the lender’s investment is protected. Policyholders should review their policies carefully to ensure they meet these requirements and offer adequate protection. Regularly updating your policy to reflect changes in your home’s value or situation is essential, as it guarantees you’re adequately insured at all times.

What's Covered: Exploring Common Policy Clauses

Homeowners insurance is a cornerstone of financial protection for any property owner. When you purchase a policy, it’s crucial to understand what’s covered under your specific plan. Common policy clauses play a pivotal role in shaping the extent of your protection against unforeseen events that could impact your home and belongings. These clauses can vary significantly from one insurer to another, so it’s essential to read your policy document thoroughly and consult experts when needed.

One of the core aspects covered under homeowners insurance is property damage. This includes protection against perils like fire, lightning, wind, hail, and vandalism. For instance, if a sudden storm causes extensive roof damage or a burglary results in broken windows, your policy could cover the necessary repairs or replacements. Additionally, personal liability coverage is another critical component. It shields you from financial responsibility for injuries or property damage that may occur on your premises, protecting you from potential legal claims and their associated costs.

Homeowners insurance borrower requirements often include specific conditions related to maintaining a secure living environment. This might involve provisions for deterring burglaries through security systems or safe storage of valuable items. Some policies also cover loss or damage due to natural disasters like floods or earthquakes, but these typically require separate riders or endorsements as they’re considered higher-risk events. Understanding these clauses empowers homeowners to make informed decisions when selecting their coverage, ensuring they’re adequately protected against the unique risks that come with owning a home.

Claim Process: Step-by-Step Guide for Homeowners

When it comes to protecting your most valuable asset—your home—homeowners insurance is a crucial component of any comprehensive risk management strategy. Understanding the claim process is essential for homeowners, as it can significantly impact the outcome of a loss. This step-by-step guide delves into the intricacies of navigating a homeowners insurance claim, empowering borrowers with the knowledge to ensure a smooth and efficient recovery.

The journey begins with immediate action after a covered event occurs. Homeowners should first assess the damage, taking photos or videos as evidence. Documenting the extent of the loss is vital for the subsequent claim submission. Next, contact your insurance provider promptly, typically through their 24/7 claims hotline. During this initial interaction, you’ll receive guidance and an assigned claim number, serving as a reference point for all future communications.

Post-contact, prepare a detailed inventory of damaged or lost items, including personal belongings and structures on the property. Keep receipts for any temporary repairs or replacements to support your claim’s financial aspect. The insurance company will likely send an adjuster to inspect the damage. Collaborate fully with the adjuster, providing all necessary information and access to the property. This step is critical as it forms the basis for the final settlement. Once approved, the insurer will disburse funds according to the policy terms, ensuring homeowners can restore their homes or pursue other recovery options.

Understanding borrowers’ roles in this process is key. Homeowners insurance borrower requirements dictate specific actions and expectations. These may include promptly reporting claims, cooperating with adjusters, and providing accurate information. Adhering to these guidelines ensures a timely settlement, as delays can impact the claim’s validity. Remember, each policy has unique terms, so review your document carefully to familiarize yourself with the specific coverage and exclusions.

Types of Policies: Choosing the Right Coverage for You

When it comes to protecting your home and everything inside it, choosing the right homeowners insurance policy is crucial. Homeowners insurance policies can vary greatly in their scope and coverage limits, making it essential to understand the different types available. This decision directly impacts your financial security should unforeseen events occur.

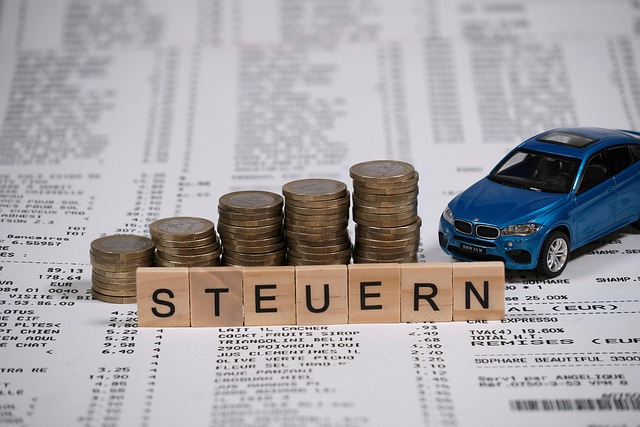

There are primarily two types of homeowners insurance policies: basic and comprehensive. Basic coverage typically includes protection against common perils like fire, theft, and vandalism. However, it often excludes natural disasters such as floods or earthquakes, which may require separate riders or policies. On the other hand, comprehensive coverage offers broader protection, including events like damage from storms, hail, or even falling objects. It also covers personal belongings, providing peace of mind for borrowers who value their possessions highly. For instance, a recent study showed that over 50% of homeowners in high-risk flood zones opt for separate flood insurance, highlighting the importance of tailored coverage.

When selecting a policy, consider your specific needs and the potential risks in your area. Assessing these factors will ensure you meet the homeowner borrower requirements effectively. Reviewing policies with a professional agent can provide valuable insights into gaps or overlaps in coverage. This process enables borrowers to make informed decisions, ultimately choosing a policy that offers both adequate protection and financial peace of mind.

Tips for Effective Homeowners Insurance Management

Homeowners insurance is a cornerstone of financial protection for any property owner. Effective management of this crucial policy goes beyond mere possession; it involves understanding specific borrower requirements and leveraging available resources to maximize coverage. A strategic approach can help ensure that in case of unforeseen events, such as damage from natural disasters or theft, homeowners are not only compensated but also able to rebuild or replace with minimal disruption to their lives.

One key tip is to review policies annually, if not more frequently, given the dynamic nature of home values and risks. This allows for adjustments to coverage limits and deducible amounts to align with changing needs. For instance, a recent study showed that over 50% of homeowners underestimated their policy’s deductibles, leading to significant out-of-pocket expenses during claims. Regular reviews can prevent such surprises. Additionally, staying informed about local building codes and home improvement trends can qualify homeowners for reduced rates as they enhance structural safety and resilience.

Another strategic move is to bundle policies. Many insurance companies offer discounted rates when multiple coverage types—homeowners, auto, life—are purchased together. This not only simplifies management by consolidating policies but also saves money. Moreover, understanding the specific homeowner insurance borrower requirements for financing or refinancing can prevent policy gaps that leave homes vulnerable. Lenders often mandate certain levels of coverage to protect their investments, and adhering to these requirements ensures continuity in protection even as ownership changes hands.

Ultimately, proactive homeowners insurance management involves staying educated about one’s coverage, keeping policies up-to-date with changing circumstances, and leveraging available discounts. By doing so, homeowners not only safeguard their assets but also gain peace of mind knowing they have the right protection in place when it matters most.