Homeowners insurance protects against unforeseen property damage or loss. Key aspects include:

– Understanding Value: Regularly assess your home's value for adequate coverage.

– Policy Tailoring: Customize policies based on location, risks (flooding, earthquakes), and assets.

– Deductibles & Limits: Choose deductibles (out-of-pocket expenses) and limits (maximum coverage) strategically.

– Prompt Claims: Notify insurers promptly after loss; adjusters assess damage, validate claims, and process payments up to policy limits.

– Regular Reviews: Update policies based on changes in your home's value, assets, and insurance needs.

Homeownership is a significant milestone for many individuals, but navigating the complexities of home insurance can be overwhelming. This article provides a strategic overview to demystify homeowners insurance for buyers, ensuring they are well-informed and protected. In today’s market, understanding coverage options is crucial before making such a substantial investment. We’ll break down key concepts, common pitfalls, and essential considerations, offering valuable insights to empower buyers in their decision-making process. By the end, readers will have a comprehensive grasp of homeowners insurance, enabling them to choose the best protection for their new home and peace of mind.

Understanding Your Home's Value: The Foundation of Insurance

Understanding the value of your home is a crucial foundation when considering homeowners insurance. This knowledge allows you to make informed decisions about the level of protection needed for your investment. Homeowners insurance isn’t just about covering repairs; it’s a safety net that protects against financial loss in case of unforeseen events like natural disasters, theft, or accidents. The process starts by accurately assessing your home’s value, which is often the single most significant asset for borrowers.

A common misconception among homeowners is that their mortgage amount determines the insurance coverage they need. While the loan balance is an important factor, it doesn’t necessarily reflect the actual worth of your property. Home values can fluctuate based on market conditions, location, and improvements made to the home. For instance, a study by the National Association of Realtors found that U.S. home values increased by 12% from 2020 to 2021, highlighting the dynamic nature of real estate value. As such, borrowers should obtain an independent property appraisal to ascertain their home’s current market value, enabling them to secure adequate homeowners insurance coverage tailored to their specific circumstances.

Homeowners insurance borrower requirements dictate that policyholders maintain accurate records of their assets and keep their homes in good repair. Regularly reviewing your home’s value and updating your insurance policy accordingly ensures you’re adequately protected. Remember, a comprehensive understanding of your home’s value is the cornerstone of effective homeowners insurance.

Types of Homeowners Insurance: What You Need to Know

When considering a new home purchase, understanding your homeowners insurance options is crucial. Homeowners insurance protects against unexpected events like fires, thefts, or severe weather damage. It also provides liability coverage, shielding you from financial loss if someone gets injured on your property. The market offers various types of homeowners insurance policies, each catering to distinct needs and preferences.

Two primary categories stand out: standard homeowners insurance and specialized policies for unique circumstances. Standard coverage includes protections for your home’s structure, belongings, and liability against third-party claims. For instance, if a burst pipe causes water damage, standard policy benefits will help with repairs or replacements. However, borrowers often need to meet specific borrower requirements set by lenders. These might include minimum coverage limits for both building and personal property, as well as liability protection.

Specialized policies are designed for homeowners with particular needs. For example, flood insurance is essential if you live in a low-lying area prone to flooding events, while earthquake coverage is beneficial in seismic zones. Some policies also offer protections against specific perils like rental income if your home becomes uninhabitable due to a covered event. Understanding these options and adhering to borrower requirements is vital for securing a smooth home buying journey. Homeowners should review policy details, compare offerings from various insurers, and consider their unique circumstances to make an informed decision regarding their homeowners insurance coverage.

Coverage Basics: Protecting Against Common Risks

Homeowners insurance is a crucial component of financial protection for any individual or family who owns a home. At its core, this coverage is designed to safeguard against unforeseen events that could result in significant property damage or loss. The basic premise revolves around providing peace of mind, ensuring borrowers are not solely responsible for bearing the costs associated with these risks. When you purchase a home, understanding the basics of homeowners insurance becomes essential, as it offers protection against common yet potentially devastating scenarios.

Coverage under this policy typically includes protection against physical damage to the property, such as from fire, storms, or vandalism. It also extends to personal liability, shielding policyholders from financial loss due to accidents that occur on their premises and result in injuries to others. For instance, if a burst pipe causes water damage to your home and belongings, your homeowners insurance would help cover the repair costs. Moreover, it could provide compensation if a visitor slips and falls on your property, with legal fees and medical expenses being covered as per the policy terms. The specifics of coverage can vary widely, but essential protection against these common risks is generally included in standard policies.

Borrowers should carefully review their homeowners insurance requirements to ensure adequate protection. This involves assessing the value of the property and personal belongings, considering potential risks in the area, and understanding the level of liability coverage needed. For instance, homeowners in areas prone to natural disasters like hurricanes or earthquakes may require specialized policies that cater to these specific perils. By tailoring their coverage to these needs, borrowers can safeguard against significant financial losses and ensure they meet the requirements set by lenders for mortgage approval.

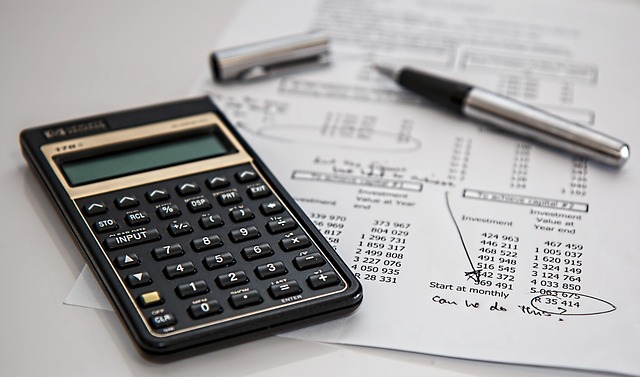

Deductibles and Limits: Navigating Financial Aspects

Homeowners insurance is a cornerstone of responsible homeownership, providing financial protection against unforeseen events. A crucial component of this protection involves deductibles and limits—the financial aspects that can significantly impact your out-of-pocket expenses in the event of a claim. Understanding these elements is vital for any homeowner, as it allows them to make informed decisions about their coverage and manage their finances effectively.

Deductibles represent the amount you agree to pay out-of-pocket before your insurance policy kicks in. For instance, if your home suffers water damage due to a burst pipe, your deductible determines how much you’ll need to cover initially. Policies commonly offer deductibles ranging from a few hundred to several thousand dollars. A higher deductible usually translates to lower premiums but requires more financial resilience during a claim. Conversely, lower deductibles come with higher premiums and may lead to more frequent out-of-pocket expenses over time. Homeowners insurance borrower requirements often mandate a balance between affordability and adequate coverage, with many lenders preferring deductibles that align with the home’s value.

Policy limits, on the other hand, cap the maximum amount your homeowners insurance will cover for specific perils or losses. These limits are crucial as they define the ceiling of financial protection. For example, if your home is destroyed by a fire, your policy limit dictates how much compensation you’ll receive to rebuild or replace it. It’s essential to assess your assets and potential risks when determining suitable policy limits. According to industry data, inadequate coverage can leave homeowners facing significant financial gaps after catastrophic events. Thus, regularly reviewing and adjusting your policy limits is a prudent step in safeguarding your financial well-being.

Navigating these financial aspects requires careful consideration. Homeowners should evaluate their risk exposure, budget constraints, and recovery preferences before selecting deductibles and limits. Consulting with insurance professionals can provide valuable insights tailored to individual circumstances. Remember, the goal is not just to have coverage but to ensure it adequately addresses potential losses while aligning with your homeowners insurance borrower requirements and financial capabilities.

Claims Process: What to Expect When Filing a Claim

When you buy a home, homeowners insurance is a crucial component of protecting your investment. The claims process is a critical aspect to understand, as it can significantly impact your experience after an incident. Here’s what to expect when filing a claim under your homeowners insurance policy.

First, promptly notify your insurer after a loss occurs. This could be due to damage from natural disasters like floods or fires, or incidents such as burglary or accidental damage. Your policy requires you to report claims in a timely manner, typically within a few days of discovering the loss. The insurer will then assign an adjuster who will contact you to discuss the incident and assess the damage. During this process, keep detailed records of all conversations, documents, and photographs related to the claim.

The next step involves filing the claim itself. Most insurers offer several ways to do this, including online portals, mobile apps, or by phone. You’ll need to provide information about the incident, the property damaged, and any relevant details that support your claim. Be as accurate and thorough as possible in your reporting. Once filed, the insurer will review the claim, verify its validity, and determine the extent of coverage based on your policy’s terms and conditions—including the homeowners insurance borrower requirements outlined in your contract.

Once approved, the insurer will provide a payment to cover repairs or replacements, up to the limits of your policy. The time it takes for this can vary, from a few days for minor claims to several weeks or more for complex cases. It’s important to understand your policy’s deductibles—the amount you’re responsible for paying out of pocket before insurance covers the rest—and communicate with your insurer if you have any questions or concerns throughout the claims process.

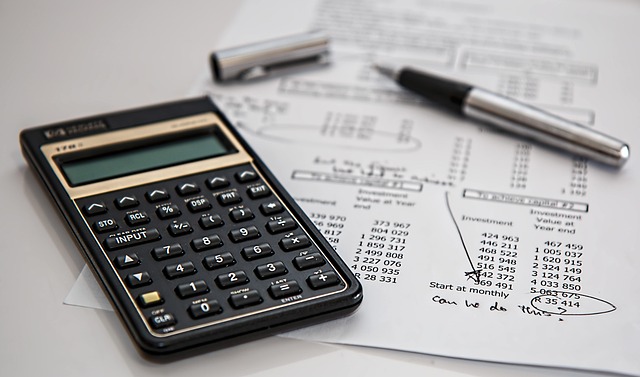

Shopping for Policies: Finding the Best Homeowners Insurance

When shopping for homeowners insurance, understanding your options and what’s covered is crucial. As a buyer, it’s essential to view this process as an investment in protecting your biggest asset—your home. Homeowners insurance isn’t just about checking boxes; it’s tailored to meet specific needs based on factors like location, type of property, and personal belongings. A comprehensive policy safeguards against financial loss from damage or theft, offering peace of mind that every aspect of your home is protected.

Start by comparing different policies side by side. Many insurers offer standard packages, but specialized carriers cater to unique situations. For example, if you live in a flood-prone area, ensure your homeowners insurance borrower requirements include specific coverage for floods. Similarly, consider optional add-ons like protection against natural disasters or identity theft. It’s worth noting that policies can vary significantly in terms of deductibles and coverage limits, so choose what aligns best with your risk tolerance and financial stability.

Next, assess the value of your home and belongings accurately. Homeowners insurance borrower requirements often involve declaring these values to determine premiums. Use recent appraisals or consult professionals for an accurate estimate. For instance, if you’ve recently renovated, updated fixtures, or acquired valuable collectibles, make sure these additions are reflected in your policy. This ensures adequate coverage in case of loss or damage, preventing financial shortfalls and potential disputes with insurance providers.

Additionally, consider the specific needs of your household. Do you have a pool or other structures on your property? Are there high-value assets like artwork or jewelry that require specialized coverage? Tailor your policy to address these factors. For instance, liability coverage can protect against legal issues arising from accidents on your property, while specific policies may be required for valuable collections or business operations conducted at home. By understanding and meeting homeowners insurance borrower requirements, you ensure a robust safety net for your investment and the security of your family.